What is Employee Wellness and Well-Being?

Wellness isn’t just a buzzword in the workplace—it’s a vital investment in the long-term success of your business. The World Health Organization defines wellness as “not merely the absence of disease and infirmity” but an overall sense of well-being. Wellness isn’t just physical wellness, it’s intellectual, emotional, spiritual, environmental, financial, occupational, and social wellness. Addressing all of these aspects helps create more balanced and resilient employees.

Why Does Employee Wellness Matter to Your Business?

Unfortunately, small businesses have historically been known for having fewer or less benefits than larger companies. However, what many don’t realize is that for small businesses, it’s actually more important than ever to have strong benefits that support overall wellness. Offering strong benefits is crucial for attracting and retaining top talent, boosting employee morale, and maintaining long-term sustainability. Unlike large corporations that can rely on high salaries, small businesses can stand out by providing wellness-focused benefits, flexible work options, and comprehensive health plans. Investing in employee well-being leads to higher productivity, lower turnover, and a more engaged workforce—ultimately saving money and strengthening company culture.

Research-Backed Benefits of Employee Wellness:

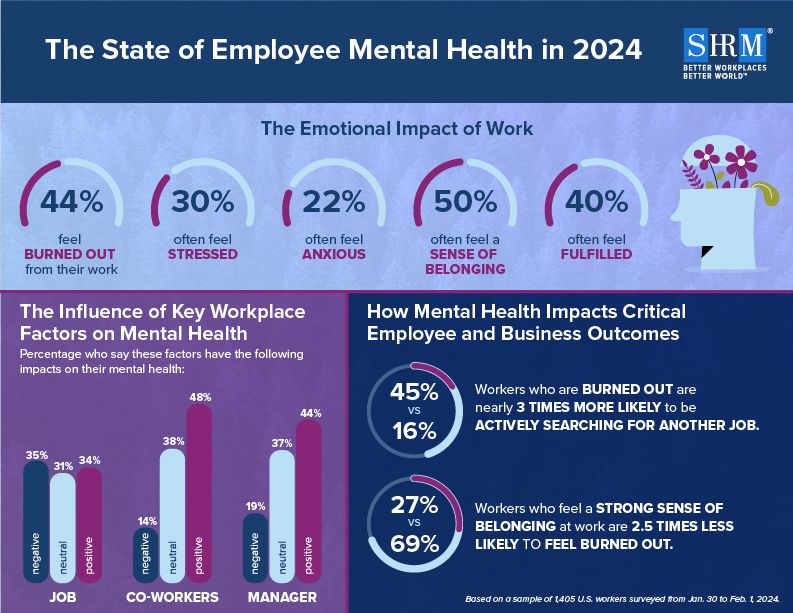

- Workers who feel supported in their well-being are significantly more engaged and productive.

- Employees experiencing burnout are 40% less likely to go above and beyond their job expectations compared to 56% of those who feel supported in their health and wellness.

- Businesses that invest in employee wellness programs report lower absenteeism, fewer workplace injuries, and higher overall job satisfaction.

Moreover, wellness initiatives reduce the risk of burnout, absenteeism, and turnover—all of which are costly for small businesses that lack large HR departments and budgets that bigger companies have to manage these challenges.

Small businesses especially benefit from offering wellness programs because they can have a significant impact on productivity and job satisfaction. Research shows that employees who are mentally and physically well perform better, are more engaged, and are less likely to burn out or leave their jobs. For small businesses that typically have fewer resources, fostering employee wellness can be the key to maintaining a loyal, high-performing team.

Well-being is closely linked with health and productivity. Research shows that employees who are in good physical, mental, and emotional health are more likely to deliver optimal performance in the workplace than employees who are not. Moreover, wellness initiatives reduce the risk of burnout, absenteeism, and turnover—all of which are costly for small businesses that lack the large HR departments and budgets that bigger companies have to deal with these challenges. 1

How Can Small Businesses Support Employee Wellness?

While large corporations may have more resources, small businesses still have a wide range of options to offer impactful wellness benefits. Here’s how small businesses can promote wellness in their employees:

Pension Plans (e.g., SEP Employer Contributions)

A great way to offer financial security is through pension plans. Small business owners can utilize SEP (Simplified Employee Pension) Plans, which allow for larger contributions than typical 401(k)s, offering a tax advantage to the business and a better retirement plan for the employees.

- Small businesses can contribute up to 25% of an employee’s compensation or $69,000 (in 2024), whichever is lower.2

- Unlike traditional 401(k) plans, SEPs are easier to set up and have lower administrative costs, making them more accessible for small businesses.

Advantages

- Contributions are tax-deductible for the business.

- Employees are immediately 100% vested in the contributions, which improves retention.

Health Savings Accounts (HSAs)

HSAs offer employees a tax-advantaged way to save for medical expenses. Offering a match for HSA contributions is an attractive option for small businesses looking to give employees a valuable benefit without a large cost.

- HSAs are available to employees enrolled in a High Deductible Health Plan (HDHP)

- For 2024, contribution limits are3:

- $4,150 for individuals

- $8,300 for families

- $1,000 catch-up contribution for those over 55

- Employer Match: While not required, offering a match helps employees grow their savings faster and reduces taxable income for both parties.

Advantages

- Tax-free growth and withdrawals for qualified medical expenses.

- Contributions reduce taxable income for employees

Paid Time Off (PTO)

PTO is essential for maintaining a balanced and productive workforce. Offering vacation time, sick days, or personal days allows employees to rest and recharge, ultimately reducing burnout and increasing long-term productivity.

- While no federal law mandates PTO in the U.S., many states have specific regulations (e.g., California requires paid sick leave).4

Flexible Work Schedules and Remote Options

Allowing employees the flexibility to work from home or adjust their hours can help them maintain a work-life balance. For small businesses, this flexibility shows employees that they are valued and trusted, improving morale and reducing stress.

- Post-pandemic, flexible work arrangements have become an expected benefit.

Challenges

- Cybersecurity risks with remote work.

- Maintaining company culture and collaboration.

Comprehensive Health Plans

Offering medical, dental, and vision coverage ensures that your employees can access healthcare when needed, without having to worry about the financial strain. Health plans may vary in scope and cost, but even basic coverage can be a great addition to a small business benefits package.

- Small businesses can offer health insurance through the Small Business Health Options Program (SHOP), which provides tax credits to businesses with fewer than 25 employees.

- Types of health plans to consider:

- PPO (Preferred Provider Organization)

- HMO (Health Maintenance Organization)

- EPO (Exclusive Provider Organization)

- HDHP (High Deductible Health Plan)

Mental Health Support

Providing mental health benefits, such as Employee Assistance Programs (EAPs), therapy stipends, or mindfulness training, can help employees manage stress and improve overall workplace well-being.

- Mental health benefits are increasingly viewed as essential, not optional.

- Options for small businesses:

- Employee Assistance Programs (EAPs): Provide confidential counseling and support.

- Therapy stipends: Fixed reimbursement for therapy sessions.

- Mindfulness and resilience training: Tools for stress management and work-life balance.

Some Additional Benefits

-

Professional Development

- Reimbursements offered for certifications, courses, and conferences shows that the business values growth.

-

Childcare Assistance

- Options include on-site childcare, stipends for daycare, or flexible spending accounts (FSAs) for dependent care.

-

Financial Wellness Programs

- Financial literacy workshops, student loan repayment assistance, and employer-sponsored debt counseling are all options that can reduce financial stress and improve job performance.

Addressing Common Challenges & Solutions

As a small business owner, you might be thinking to yourself, “I can’t afford to offer a full benefits package.” The solution to that is to start small! Start with flexible work options, PTO, or an HSA match before expanding your benefits package. Administering benefits isn’t as complicated as it seems, and you can work with third-party providers or payroll companies that specialize in small business benefits. If you’re not sure what benefits matter most to your employees, ask them! This is a great opportunity to survey your employees to determine which benefits most matter to them before you implement a program.

Wellness Is an Investment in Your Business & Your Employees Future

Providing wellness and benefits packages isn’t just a cost—it’s an investment in your company’s long-term success. For small businesses, this investment can help improve employee satisfaction, reduce turnover, and increase productivity—all of which contribute to a healthier, more successful business

While it may seem daunting at first, offering wellness benefits doesn’t have to be expensive. By focusing on the well-being of your employees, you build a team that is more engaged, productive, and loyal. For small businesses, that kind of investment can pay off in a big way. Employers must take an active role in supporting employee wellness to create a healthier, more productive workplace where everyone can thrive.

Further Reading and Information

- What do Workplace Wellness Programs do? Evidence from the Illinois Workplace Wellness Study- The article examines the effectiveness of workplace wellness programs through the Illinois Workplace Wellness Study, involving nearly 5,000 employees. While the program increased health screenings, it had no significant impact on total medical spending, productivity, health behaviors, or self-reported health after two years. Selection bias was observed, with healthier and lower-spending employees more likely to participate. The study challenges the assumption that wellness programs reduce healthcare costs and improve productivity. Read More

- The impact of worksite wellness programs by size of business– A three-year longitudinal study of participation, health benefits, absenteeism, and presenteeism- The study evaluates the impact of worksite wellness programs (WWPs) on employee health, absenteeism, and presenteeism over three years. It found that small business employees showed greater participation and health improvements, including reduced stress, better dietary habits, and increased physical activity. However, the study found no significant changes in absenteeism or presenteeism across business sizes. The findings suggest that while health benefits are achievable, direct productivity gains are less clear.

Read More -

Corporate Wellness Programs: Health Benefits With Some Legal Risks– The article discusses the benefits and risks of corporate wellness programs. Benefits include reduced healthcare costs, improved employee morale, higher productivity, and better retention. Successful programs promote fitness, healthy eating, stress management, and mental health support. However, there are legal and privacy risks when handling employee health data and implementing mandatory programs. Well-executed wellness initiatives can save businesses up to 25% on healthcare and absenteeism costs.

Read More

References

- Gonzales, Matt. “Here’s How Bad Burnout Has Become at Work.” SHRM, 30 Apr. 2024, www.shrm.org/topics-tools/news/inclusion-diversity/burnout-shrm-research-2024.

- IRS. “Simplified Employee Pension Plan SEP | Internal Revenue Service.” Irs.gov, 2019, www.irs.gov/retirement-plans/plan-sponsor/simplified-employee-pension-plan-sep.

- IRS. “Publication 969 (2018), Health Savings Accounts and Other Tax-Favored Health Plans | Internal Revenue Service.” Irs.gov, 2018, www.irs.gov/publications/p969.

- “Division of Labor Standards Enforcement (DLSE).” Www.dir.ca.gov, www.dir.ca.gov/dlse/FAQ_Vacation.htm.

Write a comment: